In February of 2010 my wife and I purchased our very first home. We have a conventional 15-year mortgage and our plan is to pay it off in less than 10 years. Our stretch goal is to pay it off in less than 7.

As of February 28, 2011, we have made 12 regular mortgage payments – and several additional principal-only payments.

When I posted last month’s update, we had paid off 4.95% of our mortgage debt.

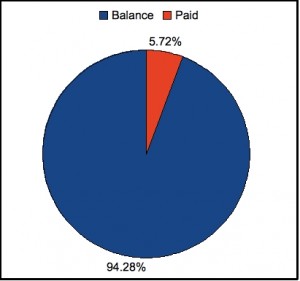

As of or most recent payment, we have now paid off 5.72% of our mortgage debt.

Here is our most recent chart –

The chart below shows two percentages. The blue percentage is how much I still owe – the balance. The red percentage is how much I have reduced – the paid.

This chart does not represent how much of my house I actually own – it simply reflects how much of our mortgage balance we have paid. We actually “own” much more than 5% of the house, based on appraised value and initial down payment.

As of today, we have made 12 regular payments and have lived in the house for just over a year. We now have right at 9 years to pay off our mortgage and reach our paid-in-10-years-or-less goal.

That’s fantastic. Is your main source of income blogging?

I’m enjoying reading about your plan and your progress. I’m personally still working on paying off some other debt, but I plan to be in full mortgage-repayment-mode by the end of 2011. While thinking ahead, I’ve read a lot about the pros and cons of doing this instead of focusing on investing, but it seems like the best choice (to my mind) is to own where you sleep, then worry about other things. It will be encouraging to track your progress. Thanks!

Have you considered switching to making payments every other week (bi-weekly)? This would allow you to make at least 1 extra payment per year without thinking.

It is difficult for me to understand all this, but it looks like to be a good idea.

Great job on paying off more and more of your mortage! It’s something I wish that other people of the world would do. I’ve never understood how people can simply pay just the monthly payment and not try to contribute more and more to their principal.

Keep up the good work and I great plan of attack!

-Ravi G.

Great strategy. I wish more people would stop to take a look at what they are doing with their money. I work with people filing bankruptcy on a regular basis, and in many cases it could have been easily avoided.

You’re doing a killer job there. I really would love to get a house while mortgage rates are low; hoping to do something similar to you.

I was going to say the same thing Mark said.

Congratulations! It is great to see people set goals and stick with them! Keep it up!