In February of 2010 my wife and I purchased our very first home. We have a conventional 15-year mortgage and our plan is to pay it off in less than 10 years. Our stretch goal is to pay it off in less than 7.

As of March 31, 2011, we have made 13 regular mortgage payments – and several additional principal-only payments.

When I posted last month’s update, we had paid off 5.72% of our mortgage debt.

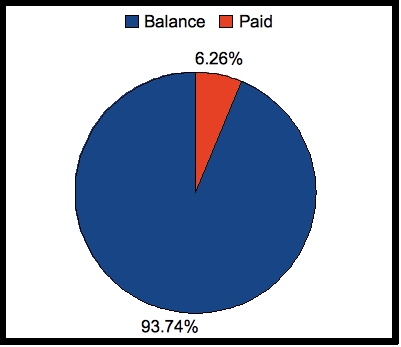

As of or most recent payment, we have now paid off 6.26% of our mortgage debt.

Here is our most recent chart –

The chart below shows two percentages. The blue percentage is how much I still owe – the balance. The red percentage is how much I have reduced – the paid.

This chart does not represent how much of my house I actually own – it simply reflects how much of our mortgage balance we have paid. We actually “own†much more than 5% of the house, based on appraised value and initial down payment.

As of today, we have made 13 regular payments and have lived in the house for just over a year. We have reduced the length of the mortgage by 3 months. That’s not bad, for just a year of working to pay off the mortgage.

March was an incredibly busy month for me and my family, as you could probably tell from the lack of blog posts. Things have slowed down (just a bit) and I plan to return to regular posting schedule.

Glad to hear you are going to be posting more!

well done with the mortgage payments!

Nicely done! You guys will have that house paid off in no time. I wish more people were like you and worked this hard to pay off their mortgage. Keep up the amazing work!

-Ravi Gupta

Great job on reducing your mortgage payments! I’ve been paying more on my principal each month which in essence amounts to an extra payment each year. But I was wondering, how you figured out that you have now reduced your payments by 3 months? Is there an online calculator you use? I’d love to know how my extra payments are affecting my payment schedule too!

We are on a similar plan – I am excited for the day that my electric bill is the biggest one each month!

Congrats to you! What an inspiration. Keep up the great work 🙂

That’s great but don’t forget to invest also. The S & P 500 is up 22% since you bought your house!

Very Cool! I am still in debt reduction mode. I have reduced my debt by 30% in the last year. I did it with a Debt Buster spreadsheet that I developed. For anybody who is still in my boat, they can download it over at my blog.

Your blog description says “We are living debt free”. So mortgage isn’t debt? I like the idea of paying off a mortgage quickly but there’s a lot of chatter out there about investing the difference instead and haven’t fully decided which to do.