In February of 2010 my wife and I purchased our very first home. We took out an conventional 15 year mortgage. Our plan is to pay the mortgage off in less than 10 years – with a stretch goal of paying it off in less than 7.

As of January 31, 2011, we have made 11 regular mortgage payments – and several additional principal-only payments. By the way, here’s our plan-of-attack for paying of our mortgage early by making those extra principal-only payments.

Long-time No Credit Needed readers will remember that I used to use charts to track my debt reduction progress (back when we were paying off our automobile and credit card loans). I’ve decided to use a new chart to share my progress. Some details –

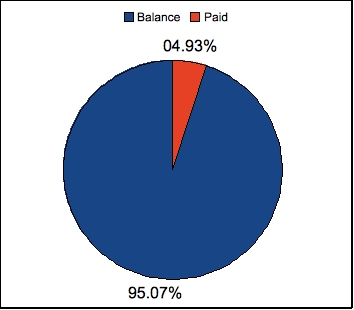

The chart below shows two percentages. The blue percentage is how much I still owe – the balance. The red percentage is how much I have reduced – the paid. So far, I’ve paid off 4.93% of my mortgage debt.

One thing to note about this chart – It does not represent how much of my house I actually own. We put down a substantial down-payment, so we actually own much more than 4.93%. This chart simply reflects the balance on the mortgage and the amount paid.

If we had simply made our regular monthly payments, we would still have 14 years and 1 month remaining on our mortgage. As it stands, we now have 13 years and 11 months. We have shaved off 2 months – and we really haven’t focused with laser-like intensity on debt reduction. A few extra dollars here and there really do begin to add up. Plus, every extra dollar spent goes directly towards principal – reducing both overall balance and interest.

It still bothers me to see just how much of our monthly payment goes towards interest. Even at present low rates, the interest still stings. Thankfully, as we reduce the principal, the amount going towards interest is reduced each and every month.

Our goal, like I said at the beginning of this post, was to pay off our house in less than 10 years. As of now, we have made 11 payments and have lived in the house for a full year. Can we turn our now 13 years-and-11-months-mortgage into a 9 years-or-less-mortgage? Stick around and find out! Debt reduction rocks!

Final note: I realize that I jump back and forth, using the pronouns “I, we, our, my, mine, ours”. This is a terrible writing habit – but it does reflect our attitudes. My wife and I have combined our finances and our lives – so there really isn’t a difference between “mine” and “ours”.

Generally, the shorter the term of a mortgage, the lower the interest rate you can avail. Thus, the more money you save on interest. For borrowers who opt for short-term plans, make sure you have considerable savings in your account to stick up for unexpected job loss or hefty emergency expenses.

Great post… the number that always inspires me is how much I will save at the end of a mortgage by just by $xx amount extra each month.

I certainly appreciate your approach to paying down your mortgage — we do the same here, although I add the additional payment toward interest into my regular mortgage payment (saves on the cost of making an additional payment online). I know it “bothers you” to see how much goes to interest, but during the early years of the mortgage, having that high interest payment does help on taxes; you can now itemize taxes and reduce tax payments by listing your interest paid on the house, property and school taxes, and then things like charitable donations. So, even though you are paying a higher interest, the homewonership does provide you with additional benefits. Love your blog…always inspiring.

Elise,

You are definitely correct about the tax deduction. Thanks for the kind words.

-NCN