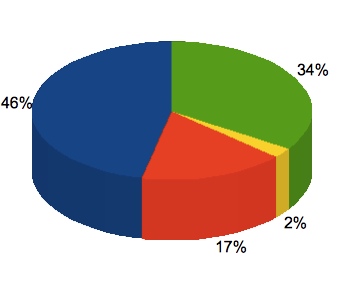

Here’s a look at our current retirement investment portfolio. These numbers are current as of today. This breakdown does not include my wife’s pension plan, nor does it include money invested for college education savings. We use four accounts to save for retirement (in addition to my wife’s pension). My 403(b), my Roth IRA, my wife’s Roth IRA, and a SEP IRA for business income investing.

Large Cap / Total US Market = 46%

Mid Cap / Small Cap = 34%

International = 17%

Cash / Bonds = 2%

The majority of the large cap / total US market stocks are held in Vanguard’s VTI ETF – which tracks the broader US market. The majority of mid / small cap stocks are held in my 403(b) via a REIT. All of the international stocks are held in a fund with my 403(b). I recently made a change to my future contributions, so the amount held in cash / bonds should increase, as a percentage of the portfolio, over time.

One of my goals for 2009 is to fully-fund my 403(b) ($16,500). I also hope to fully-fund my Roth IRA ($5,000) and my wife’s Roth IRA ($5,000).

This is my personal portfolio, constructed after doing my own research and according to my own risk tolerance. I may even change it in the future. It is not a recommendation to purchase any specific securities. I am not a financial professional or investment adviser, nor do I play one on the web.

NCN, curious why your mid/small caps are primarily in a REIT. Many treat a REIT as a separate asset class.

@Dough Roller I know. I don’t know why, but that’s how they are classified w/ my 403b. Next time, I might try to break the chart down just a bit more.

-NCN

fully fund at $5,500? The contribution limit is $5,000 for your age.

@Mike Silly typo… Thanks!

I agree with dough roller. A REIT is treated as a separate asset class compared to mid/small cap. There’s nothing wrong with owning REITs, the diversification benefit is very good. The same is true for small cap stocks. They are just different asset classes.