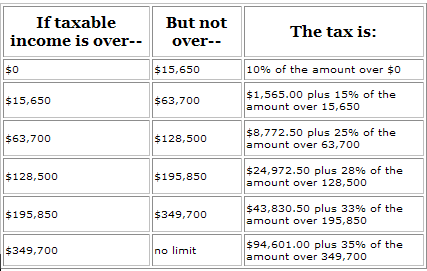

I will be the first to admit – I know very, very little about taxes. So, in an effort to learn a little bit more about ‘tax rates’, I did a search of the IRS website and I found this page – 2007 Federal Tax Rate Schedules. (Please visit the IRS site for detailed information about your tax rate. I’ve provided a summary of the information provided for those who are Married – Filing Jointly. This summary is provided solely for the purpose of discussion, and you should consult with a qualified tax professional before making any tax-related decisions.)

Married – Filing Jointly

When most people talk about their taxes, they talk about their “tax bracket”. I have been thinking about my “tax bracket” – and since my wife and I earn between $63,000 and $128,500 – I assumed that I was in the 25% “tax bracket”. I was, as is often the case when it comes to stuff like this, wrong. Or, at least, I was “kinda” wrong.

See, my “tax bracket” is the percentage of tax that I pay on my “last dollar” I earn. In my case, that would put me in the 25% “tax bracket”.

So, if I want to figure my federal income taxes for the year, I just multiply my taxable income by .25 and, bingo, I know how much I’ll owe, right? In the words of Lee Corso, “Not so fast, my friend!”

The .25 is multiplied by the amount of taxable income that I earn ABOVE $63,700. Different rates are applied to the amount I earn BELOW $63,700.

Let’s assume, just for this example, that my wife and I had a taxable income of $70,000. (This, by the way, is not the time or place to discuss what “taxable income” is. See the bottom of this post.)

We would pay a 10% tax on the first $15,650 of our income. ($1,565)

We would pay a 15% tax on the next $48,050 of our income. ($7207.50)

We would pay a 25$ tax on the next $6,300 of our income. ($1575)

If our taxable income was $70,000, our total federal income taxes would be $10,347.50.

Our EFFECTIVE tax rate would be 14.78%.

Again, I will remind you that I know very, very little about taxes, but I think I have this right. Please, if you have corrections or observations, I’d love to read them. Leave a comment!

A few quick notes:

1. Taxable Income is (generally speaking) gross income minus deductions.

2. $70,000 is just a random number that I chose for my example.

3. One of my goals for 2008 will be to reduce my taxable income.

4. My wife and I have been thinking about opening a 403b for her, through her work. By doing so, we could reduce taxable income for 2008 – but NOT by as much as I thought. One of the selling points – mentioned several times by one particular financial salesman – has been the ‘fact’ that our taxes would be reduced ‘by 25%’. Clearly, that isn’t the absolute truth. Our taxes will be reduced, but the EFFECTIVE rate of reduction will be much less than 25%.

5. Our tax system is very, very, very difficult to understand. I would prefer a flat-tax or a national sales tax – if only for the sake of simplicity.

I think your logic is right. You are actually paying an amount equal to 14.78% of your income. That said, I believe the reason that they like to tell you that you are saving “25%” is because the money comes right off the top, the part you are paying 25% on (unless you put in more than $6,300 a year in your example).

If you put in exactly $6,300, your effective tax rate will only be reduced by about 1% (to 13.77% of your taxable income), but you will be banking the entire $6,300 rather than having only 75% of that ($4725) so you are still gaining 25%.

Nice breakdown, very helpful. Information like this is very useful for someone getting close to jumping into the next income bracket. If you are working overtime or doing something else to earn extra money, you may in fact end up with less if you make just enough to move into the next bracket- clear evidence in my mind that this is a poorly designed system.

Brandon is right on the actual tax reduction. Your tax bill will be reduced by 25% of whatever contributions you make (not 25% of your total taxes).

Also, you should understand the flat tax as well before you jump on board. Check out my post on it from a couple weeks ago and you won’t be too thrilled with it either!

http://realworldfinances.blogspot.com/2007/10/flat-tax-system-whats-your-view.html

There is no reasonable equity of distribution under the current INCOME tax system. What’s more, the income tax code has become a tinkerer’s paradise for 53% of the lobbyists who game it in Washington DC. It’s a lucrative business, and the U.S. TAXPAYER pays for ALL of it in higher prices (a hidden tax which is incomprehensible to the average working person).

However, if the FairTax bill (HR 25 / S 1025) were made the Law of the Land, the fiscal landscape of the Republic – and each person’s contributiont to it, would look quite different.

Prices AFTER FairTax would look SIMILAR to prices BEFORE FairTax – NOT 30% HIGHER – as opponents contend; competition would see to it. The FairTax rate on new items would be 29.9% (on the new, reduced cost of items because business isn’t taxed under FairTax – thus lowering retail prices by 20% to 30%), or 23% of the “tax inclusive” price tag – this is the way INCOME TAX is figured (parts of the total dollar).

The effective tax rate percentages, that different income groups would pay under a FairTax consumption tax, are calculated by crediting the monthly “prebate” (rebate of tax on necessities) against all likely monthly spending of citizen families (1 member, and greater based on figures established by the Dept. of HHS – a single person receiving ~$200/mo. A family of four receiving ~$500, in addition to family earners receiving their WHOLE paycheck). Prof.’s Kotlikoff and Rapson (10/06) have concluded,

(From study: http://snipurl.com/kotcomparetaxrates ) “…the FairTax imposes much lower average taxes on working-age households than does the current system. The FairTax broadens the tax base from what is now primarily a system of labor income taxation to a system that taxes, albeit indirectly, both labor income and existing wealth. By including existing wealth in the effective tax base, much of which is owned by rich and middle-class elderly households, the FairTax is able to tax labor income at a lower effective rate and, thereby, lower the average lifetime tax rates facing working-age Americans.

“Consider, as an example, a single household age 30 earning $50,000. The household’s average tax rate under the current system is 21.1 percent. It’s 13.5 percent under the FairTax. Since the FairTax would preserve the purchasing power of Social Security benefits and also provide a tax rebate, older low-income workers who will live primarily or exclusively on Social Security would be better off. As an example, the average remaining lifetime tax rate for an age 60 married couple with $20,000 of earnings falls from its current value of 7.2 percent to -11.0 percent under the FairTax. As another example, compare the current 24.0 percent remaining lifetime average tax rate of a married age 45 couple with $100,000 in earnings to the 14.7 percent rate that arises under the FairTax.”

Further,

(From study: http://snipurl.com/kotftmacromicro ) “…once one moves to generations postdating the baby boomers there are positive welfare gains for all income groups in each cohort. Under a 23 percent FairTax policy, the poorest members of the generation born in 1990 enjoy a 13.5 percent welfare gain. Their middle-class and rich contemporaries experience 5 and 2 percent welfare gains, respectively. The welfare gains are largest for future generations. Take the cohort born in 2030. The poorest members of this cohort enjoy a huge 26 percent improvement in their well-being. For middle class members of this birth group, there’s a 12 percent welfare gain. And for the richest members of the group, the gain is 5 percent.”

It’s well past time to scrap the tax code ( http://snipr.com/scrapthecode ) and pay for government the way that America’s working men and women are paid – when something is sold.

(Permission is granted to reproduce in whole or part. – Ian)

Wow, I was just trying to wrap my head around this the other day. At work last week, we had a company come talk to us about Open Enrollment, and encouraged us to use their online calculator to determine how much we would save if we opened a Flexible Spending Account. I had to enter in my tax bracket in the online calculator, and I had no idea what it was. When I went to the IRS website, I was just as confused. This somewhat clears it up for me 😉 Thanks!

I disagree with comment #2. As I understand income taxes – and as you described in this post – if I cross the threshold into another tax bracket, it’s still impossible for me to end up with less income after taxes than if I hadn’t crossed the threshold. Instead, I’ll just reap a lower net benefit from that additional income (vs. income taxed in the lower bracket) given the additional income is taxed at a higher rate.

I’m not sold on the national sales tax yet – but am definitely open to discussion on both it and a flat tax. I have no bias; I’m just admittedly undereducated. A question regarding the sales tax idea however, is what happens to the trillions of dollars sitting in Roth accounts or taxable savings/investments? I invested that money under the promise if I paid tax on it now, I could withdraw it tax free (aside from capital gains on the taxable investments). If they kill the income tax and institute a national sales tax without taking any additional action, I just got seriously screwed.

Again, I’m not pro- or con- this idea, I’m just curious how it will be implemented in light of all savings/investments earned prior to the institution of the national sales tax. Under such a scenario as I’ve mentioned, people who have lived beyond their means and haven’t saved a dime should love it. While the rest of us who have saved – with readers of this blog included in this second category most likely – getting doubly taxed.

Food for thought.

Flat tax! Yes! Or vote for Ron Paul and have taxes abolished altogether. 😀 Man, what couldn’t I do with the money the gov’t steals from me.

This is why rather than saving 15% as DR suggest, I think maxing out retirement contributions are far and away better. If you max out your 401k and are in the 25% bracket you are saving paying 25 cents/dollar. That outweights your 6% mortgage (Which is also 25% deductible).

So no don’t keep your mortgage for that tax break, but rather the break of not having to pay taxes on it right now.

I still don’t get why people pass up free money like saving in a 401k when given? I’d love chances to put more money in and pass less taxes.

Nice Explanation!!

Yep, also disagree with #2. You’ll be taxed on the amount OVER that tax bracket at the next tax bracket, not the whole amount. I was under the same impression for a LONG time.

I think this is a little dangerous because at one time I actually thought about if I’d be LOSING money after getting a raise. This explanation is great for dispelling that fear.

Bob is correct. Moving up to another tax bracket will not reduce your take home pay. It just means that you’ll get to keep less of the last dollars that you earn in a given year. The place you can get into trouble is with the AMT.

Great post! I finally figured this out two months ago after spending some time on the IRS site. After figuring it out, I was embarrased for thinking I was in the 25% tax bracket for so long..and thinking about it as ‘moving up a tax bracket’ after making more money. It’s ridiculous that everyone has to pay taxes but I don’t know anyone who could explain tax brackets to me (I asked around before researching).

#2 is wrong for the most part except for possibly one potential perspective. I think (I am not sure about this) it is possible that you could end up making less in the short term if you had a job with irregular paychecks. When taxes are taken out of a paycheck based on your W-4, it is calculated based on receiving that amount of pay with some regularity. As a result, I believe that if you were to receive checks of varying amounts irregularly, some of these checks may calculate you as being in a higher bracket than you would be at the end of the year and as a result take a larger chunk than they should of parts of the earnings. You would obviously get this amount back when you filed though.

I could be wrong about this. The only calculator I found in a brief search was at http://www.paycheckcity.com/netpaycalc/netpaycalculator.asp and it only covered regular pay periods.

So, If I’m married, and we both make the same amount of money, then are we much better off by filing separately???

I think I’ll forego a national sales tax, thanks. Poor and middle class people spend all or nearly all the money they make. Smart rich people (i.e. not MC Hammer) spend less than they make. Ergo, sales taxes are the most regressive form of taxation in existence. A flat tax would be nice, however.

I don’t believe anyone has mentioned that the “Fair Tax” could potentially create a vary large black market. I’m all for a flat tax!

The “25% reduction” does not say 25% of what. Frequently a weakness of sales folks and others who have an agenda. The 403(b) contribution would, more correctly, defer the tax on the contribution and the related earnings. The true and final effect is not subject to accurate prediction. Factors to consider are future tax rates and policies as well as, under current law, deferring the tax but converting the tax on the earnings from 15% on long term capital gains and qualified dividends to the marginal ordinary income rate for deferred comp.

Complicated.