Click here to read all of the 33 Days And 33 Ways To Save Money And Reduce Debt posts.

Day 15: Understand The Big Picture

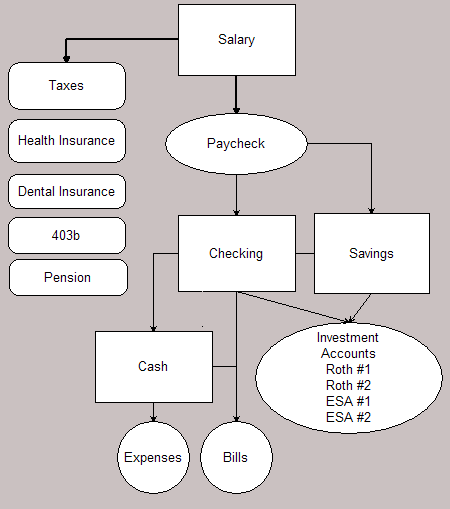

I’ve been thinking about ‘the flow of money’ – the path that money takes from my employer, to me, and out into the world. Here’s a diagram to illustrate:

As you can see, a large portion of my income is dispersed before it ever reaches my bank account. The rest of my income comes to me in the form of a paycheck. I can determine, in some ways, how big or small my paycheck is by changing the amounts that I contribute to my 403b account and how much I instruct my employer to withhold for taxes. I can also adjust the types of group insurances that I want to purchase. If you are struggling to make ends meet, you might want to take a look at your pre-tax withholding. On the other hand, if you have surplus at the end of the month, consider ratcheting up your contributions to your 403b or 401k. Remember, the more that you can contribute to your 401k / 403b, the lower your income tax bill will be.

Once you receive your paycheck, the real work begins. As you can see, I divide my paycheck between cash, checking, and savings. I use cash to pay for daily expenses. I pay my bills using the money in my checking account. I use my savings account as a holding place for my emergency fund and a temporary holding place for after-tax investment contributions. Once a month, I initiate a withdrawal from my savings account to one of my four investment accounts.

If need be, I can transfer money between my checking and savings accounts. Finally, if I am under-budget for a particular month, I can make a payment directly from my checking account to any of my various investment accounts.

So, what’s the point? You have to understand how one section of this diagram can affect the other sections of this diagram. If you are withholding too much for income taxes, the amount you have for investing will be lowered. If you are withholding too little for retirement, you income tax bill will be higher. If you are spending every dime you bring home, you will have nothing left over to save for your children’s education. If you send every extra dollar to your Roth IRA, you might not have enough saved in your emergency fund. Who knew that your 401k and that bowl of cereal you ate this morning were connected?

The reality is, managing your personal finances can, quickly, become complicated, even overwhelming. That’s why you must have a plan. You must prepare for the future. You must understand the long-term implications of the decisions that you are making today.

Have you had one of those moments where you realized that you need to learn a lot more about how to manage your finances? Leave a comment and let us know. If you are a blogger, write a post about managing your finances and dealing with the complexity of the issue, and contact me. I’ll be more than happy to link to your post.

Click here to read all of the 33 Days And 33 Ways To Save Money And Reduce Debt posts.

Great flowchart!

What you need to do is make that chart and have all the figures in it in proportion to the amount of money that goes into each of those accounts/expenses.

So basically pay yourself first and then bills and expenses!