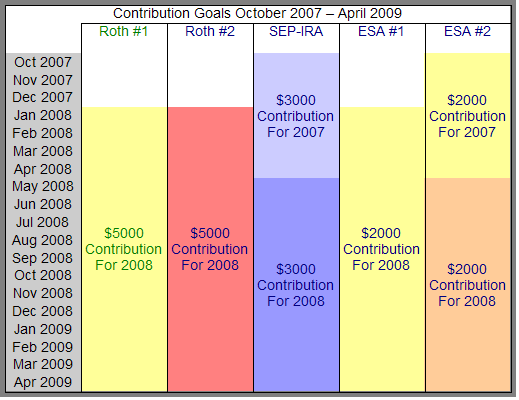

I like to create simple, easy-to-understand, financial goals. I have created a chart, outlining my ‘contribution goals’ for the next few months. I will make contributions to two Roth IRAs, two Education Savings Accounts, and a SEP-IRA.

(I also contribute to a 403b through work and my wife contributes to her pension plan. The chart reflects contributions to be made from ‘take-home’ pay.)

Contributions to the ESAs and Roth IRAs are made with ‘after-tax’ dollars – and grow ‘tax-free’.

Contributions to the SEP-IRA reduce current taxes and will be taxed when withdrawn.

Contributions in green have already been made.

Contributions in blue still need to be made.

I have already fully-funded Roth IRA #1 for 2008.

I am working to fully-fund ESA #2 for 2007 and the SEP-IRA for 2007 before April 15th.

According to the IRS website –

What is the time frame for depositing contributions into SEP-IRAs? IRS Retirement Faqs

Contributions for a year must be deposited by the due date (including extensions) for filing your Federal income tax return for the year.

Contributions (to ESAs) must meet the following requirements. IRS Publication 970

They must be made by the due date of the contributor’s tax return (not including extensions).

When Can You Make Contributions (to Roth IRAs)? IRS Publication 590

You can make contributions to a Roth IRA for a year at any time during the year or by the due date of your return for that year (not including extensions).

So, technically, if I were to file for an extension, I could have a few more months to fund the SEP-IRA for 2007 – but, I’m not filing an extension, so my deadline will be April 15th.

Finally, while this chart reflects a goal date of April of 2009, I will try to fully-fund all of these accounts much sooner.

Congrats on having your Roth IRA fully funded for this year. I’m quite jealous.

Hi there. Looks good. You may want to double check, but I dont think that even when you file an extension for your taxes that you get an extension on your contribution time. I used to work for a very large investment company and I seem to remember that people thought this was the case quite often and would delay their taxes just to make the contribution and get the deduction…but they were sourly suprised. If youre sure- great– ignore me, I just hate to see someone get in a bind! Keep up the great work here– I love the site 🙂

Nicole – I talked to a CPA, and he indicated that since I have a single member LLC, my SEP-IRA contribution deadline is the deadline for filing the business taxes, including an extension. And, the IRS site seems to agree.

The deadline for other accounts is April 15th…

NCN

What is the SEP IRA for?

@LAL –

A SEP-IRA is a business retirement account, which can be opened by owners of a a ‘small’ business. I make money from blogging, and I can contribute a portion of it to my SEP-IRA.

Wow, you have done a great job with planning (and in many cases funding) all those accounts! I’m impressed. I still have to dig out the $4K for my 2007 IRA, but that’ll be done within a month… somehow…