When I was a kid, I collected comic books. One of my favorites comics was What If? – which featured such interesting ideas as “What If… Spider-Man had joined the Fantastic Four” and “What If… Captain America became President?”.

With that bit of nerdiness in mind, “What If… You Make Maximum Retirement Contributions For 20, 30 or 40 Years?”

Notes about the charts –

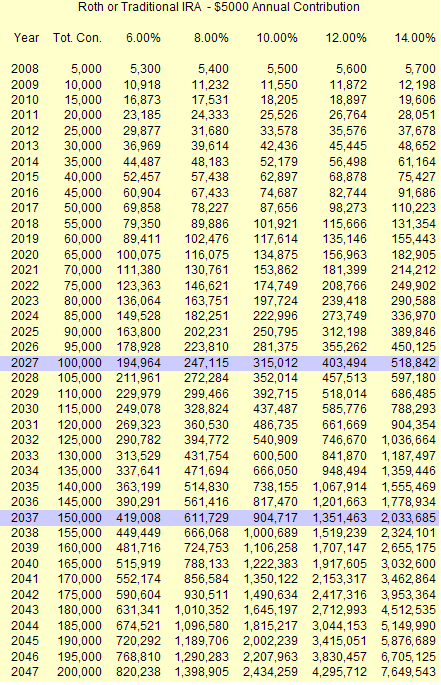

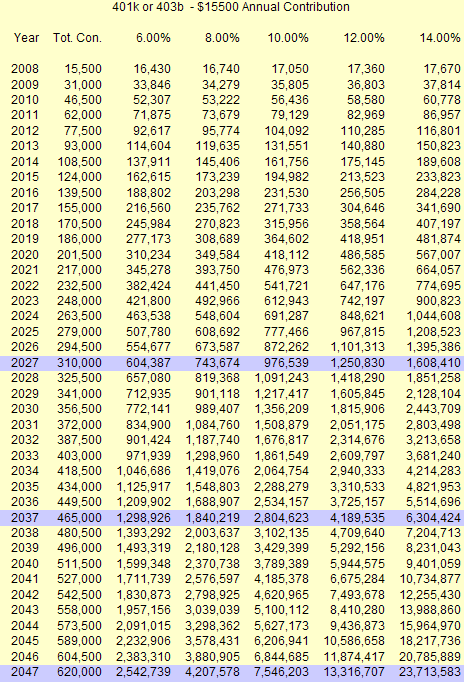

- Annual contributions are held steady at 2008 maximums

- Returns are annual and do not fluctuate

- Interest is calculated using year-end-balance

I used percentages between 6% and 14% and a span of 1 to 40 years.

What If You Make Maximum Contributions To A Roth or Traditional IRA?

What If You Make Maximum Contributions To A 401k or 403b?

I am amazed by the power of compounding interest. I realize that I cannot expect a 14% return for 40 years – but the purpose of this chart is to get us all ENERGIZED about saving for retirement. For 2007, I managed to fully-fund my Roth, my wife’s Roth, and my 403b – only 39 years to go! 🙂

I like to do what if scenarios too, but this is very neat. Thumb up for you!

I did something similar. I maxed out my retirement plan at work, and my IRA. I also saved outside of retirement plans. Our income (wife and I) never exceeded $70,000 in a year – usually less – and sometimes much less. In just 14 years:

— we owned the house free and clear

— had zero debt

— bought a very good long-term care policy for both of us and paid it off in one lump sum – I don’t think they’ll do that anymore.

–helped put two kids through college (both accumulated zero undergraduate debt).

— had over a million dollars in assets (not even counting the house, cars, personal possessions, or long-term care paid off

So I just quit my job at age 52… just a brief notice and left. Now life is like a dream come true.

Another interesting tidbit: I added up every penny my wife and I have ever earned, even as teenagers (I used the Social Security printout). When I quit my job, we had more assets than the sum of everything we had ever earned in our lifetimes.

This is almost like magic. It takes some work and knowledge, but it is doable by a lot more people than are actually doing it.

It is true however not all of us can do what you did. With a little restraint and planning it is easy to become debt free and even begin to grow your assets.

Thanks for the inspiration – I’ve done a similar calculation for the situation in Australia under the new contribution rules. American readers may be interested to see how we compare:

http://enoughwealth.com/2007/11/what-if-you-make-maximum-retirement.html

Regards

http://enoughwealth.com

What would the USA or other countries look like if a majority of people would pay off debt and live debt-free? I have always wondered about this because it seems like a lot of people are in debt (including myself). We are currently working on it and hope to out very soon, never to return to the lifestyle of debt.

Compound interst is my friend. I always tell people you are throwing away $1,000 a day every day they let go by that they haven’t started their 401k. I am a youth pastor and I always tell my students to open an account as sson as they get a job.

So does it make sense to maximize all retirement options before paying off the mortgage? I am of the opinion yes, but many who follow DR aren’t. My train of thought is you can’t go back in time and contribute.

I just got out of debt this year. I was still contributing 20% of my pre-tax income to my 401k while doing it, however I hadn’t contributed to my Roth IRA (actually, I stopped that years ago when I was laid off and haven’t contributed since). Now that I’m out of debt, I’ve built up a $1,000 emergency fund and by the end of the year I’ll have three months of expenses saved up if I lose my job. I’ll start contributing the max to my Roth again in 2008. However I don’t believe I can contribute the max ($15,500) a year to my 401k on my $45k salary. I thought I was doing well with my 20% ($9,000). Oh well. I’ll just have to do the best I can with what I’ve got and hope for the best.

Thanks for the info. I’ve often thought that as long as we can max out our 401(k)s from now until retirement, we will be ok in retirement and these numbers support that. (Obviously, there are tons of variables at play: actual return, cost of living, inflation, etc., but it does give a comfort level.

you should find out how much those amounts will actually be worth after 40 years by including inflation.

no kidding – how great is compound interest? Well, apparently not great enough to teach a kid when he is 12 to put a bit away each month. I recall my parents telling me to save just a few bucks a month from my paper route. Did I listen? No. Do any kids listen? No. I guess that’s the point of being a kid though, eh? 🙂 Nicely done… I’m motivated! I always am!

I had to wait a year after I started working to be eligible for the 401K at my place of work, but I signed up as soon as I could do so. I maxed out my 401K ($15,500 this year) but I could actually save more than that so the rest goes into taxable investment accounts.

at Jason –

NCN didn’t increase the amount of the contributions by inflation, so I think the model is basically ‘inflation adjusted’.