I’m working towards saving $48,000 this year, which is 60% of our gross household income.

Click here to read all posts associated with my $48000 goal.

Click here to read about my savings and investing goals for 2007.

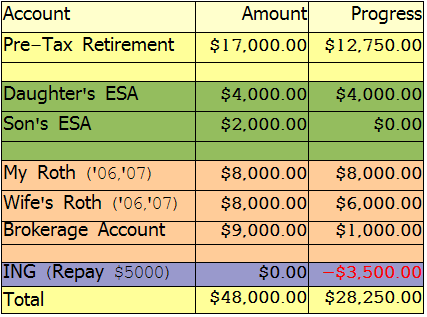

Here’s my updated chart with detailed information:

Explanation: I ‘borrowed’ $5000 from my ING Direct Savings Account so that I could fully-fund my Roth IRA for 2006. I’m in the process of ‘paying myself back’. Since last month, I’ve managed to deposit $2000 into my wife’s Roth and an additional $1500 into my ING Directs Savings Account.

At this point, I should have saved $4000 per month for a total of $32000. But, I’ve only managed to save $28,500, so I’m $3500 “short” of where I had hoped to be. Why? When calculating my budget for 2007, I made a major miscalculation and forgot about a $500 per month recurring expense. Still, I pretty pleased with my progress and I’ll be working very hard to reach my goal by December.

(You can also follow my progress over at the No Credit Needed Network: NCN 2007)

OMG. 60%? That’s great! I’m still saving about 22%, but some of it’s FSA money. I still have a NCN Network chart to pay off…