I thought I’d take a peak at my Roth IRA and see how it was performing. My wife and I have four primary retirement funds. I have a 403b through work, she has a pension plan through her work, and we both have Roth IRAs. I’d breakdown my investment philosophy thusly:

Pension Plan:Â My wife’s plan will provide guaranteed retirement income, so, no real worries here unless she were to change jobs or get sick.

403b: I’m pretty aggressive with my 403b investments. I invest in a small cap mutual fund, an international growth stock fund, and a REIT.

Roth #1 (My Wife’s):Â In this account, we stick to “safe” index-based ETFs.

Roth #2 (My Roth):Â In this account, I invest in single stocks, trying to buy stocks that have a dividend and / or appear to be “good values”.

(I’m not an investment professional, and I would NEVER give investment advice. I’ve read several books on investing, and every time I read a book, I think, “NOW I understand!”. Then, I read another book and I completely change my mind! The above breakdown represents what I’m doing TODAY. By tomorrow, I may change my mind and become more conservative, or, conversely, I might change my mind and become much more aggressive. Honestly, my main goal at this point is to save as much as I can, upfront, and learn as I go along.

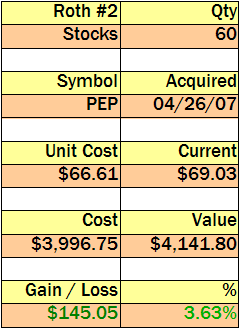

Here’s the current chart for my Roth IRA, Roth #2:

As you can see, I purchased 60 shares of PEP (Pepsico) in April. Since then, the price of the shares has gone up, which is always a bonus. I’ll update this account, and the others, from time to time.

Pensions aren’t as “guaranteed” as they used to be. When companies are bought out (such as the recent Chrysler buyout) or when they spin off underperforming divisions, many times the new owners cut pensions.

Most companies look at pension plans as a huge liability, especially now that the baby boomers are getting to retirement age. GM, for example, gave its employees very generous pension plans in the 70’s because they could report higher profits if they gave the employees less wages with higher benefits. Now that GM realizes that the retirement benefits left to pay out is over $50 billion, its killing them, especially since foreign manufacturers have been steadily stealing away market share.

My wife is a teacher, working for the state. So, I guess, as far as pensions go, that’s about as ‘guaranteed’ as you are going to get. Of course, should that change, we’ll go in another direction.

PEP is a good blue chip stock! I own it also in my Roth IRA via a mutual fund