Click here to read all of the 33 Days And 33 Ways To Save Money And Reduce Debt posts.

Made popular by Dave Ramsey, the Debt Snowball allows for rapid debt reduction. I used the Debt Snowball and managed to pay off $11,500 in 10 months. The debt snowball worked for me and my family!

Here’s a quick overview of how the Debt Snowball works:

- List all debts – either from lowest balance to highest balance OR highest interest rate to lowest interest rate – and make minimum payments to all accounts.

- Make an extra payment to the first account on your list.

- After paying off the first account, take the combined amount (minimum payment and extra payment) which had been going to the first account, and apply it to the second account.

- Repeat until all of your accounts have been paid off in full.

The following charts illustrate the power of the Debt Snowball.

Note: I have listed accounts ‘lowest balance to highest balance’ – but you might choose to list them ‘highest rate to lowest rate’. Pick the method that suits your personality.

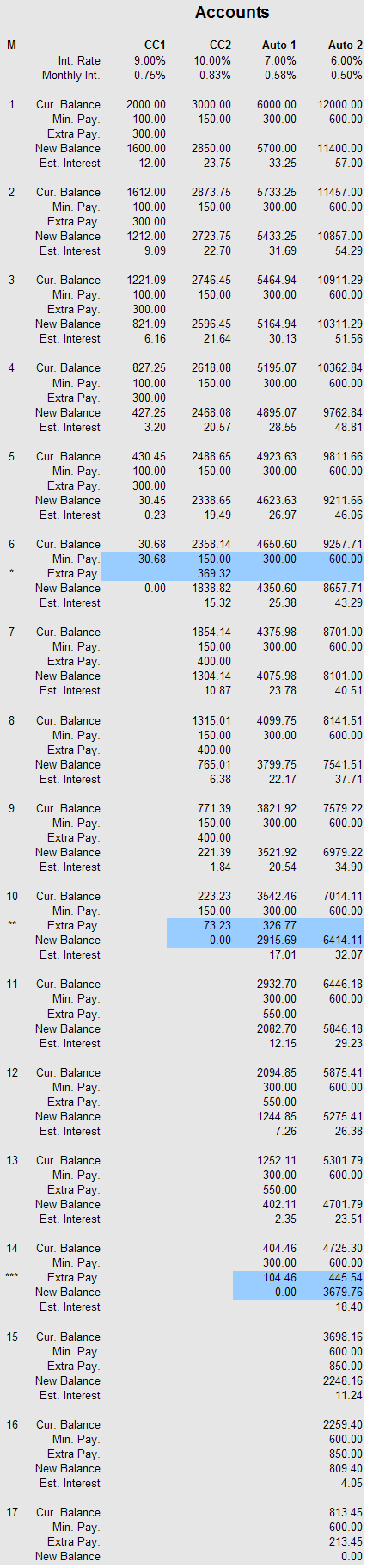

Chart 1: The Setup

- Accounts have been listed by their balances – lowest to highest

- Monthly Interest is an approximation – annual rate divided by 12

- Extra payment amount is $300

- M – Month

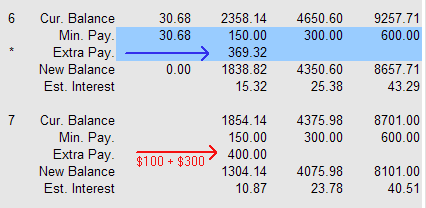

Chart 2: After Six Months

- Account #1 has been paid off

- (Blue Arrow) Amount not needed for Account #1 is added to Extra Payment

- (Red Arrow) New Extra Payment amount = Account #1 Minimum + Original Extra Payment

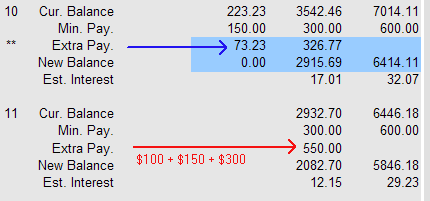

Chart 3: After 10 Months

- Accounts #1 and #2 have been paid off.

- (Blue Arrow) Amount not needed for Account #2 is added to Extra Payment

- (Red Arrow) New Extra Payment Amount = Account #1 Minimum + Account #2 Minimum + Original Extra Payment

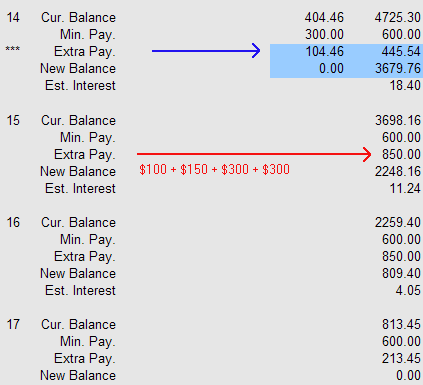

Chart 4: After 14 Months

- Accounts #1, #2, and #3 have been paid off.

- (Blue Arrow) Amount not needed for Account #3 is added to Extra Payment

- (Red Arrow) New Extra Payment Amount = Account #1 Minimum + Account #2 Minimum + Account #3 Minimum + Original Extra Payment

Chart 5: Complete Chart

As you can see, by focusing on one account at a time and then ‘snowballing’ your payments, debt reduction occurs rapidly. In effect, instead of four separate ‘debts’, all accounts are treated like one ‘big debt’.

Leave a comment if you’ve used the Debt Snowball method to get out of debt.

Click here to read all of the 33 Days And 33 Ways To Save Money And Reduce Debt posts.

Excellent illustration!

I love seeing your chart! We are using a debt snowball, but one that Mary Hunt is credited with, and we also are always moving our balances to low rates in addition (something most snowballs don’t have you do).

It’s working well, and we plan to be out of debt in 2 years! 🙂

NCN

This is a great illustrative way of showing the debt snowball. I created a google docs spreadsheet almost exactly like this but with color so I could track our progress. It really helped because we have been debt free for a few months now!!!

Keep up the great work!

Thank you, you don’t know how many times I have tried to tell people about this only to be met with blank looks. I was told about this years ago and what do you know, it works. But only if your dedicated to sticking to your budget. One month of slacking off hurts.

What a great way to teach people how to knuckle down and get rid of their debt! As John K says, people don’t usually understand the process. But you’ve done a wonderful job of SHOWING them.

I’ve made an Excel model that allows you to simultaneously view all scenario’s – lowest APR first, highest APR first, lowest debt first (lowest APR first as the ‘worst case scenario’).

It shows that, unless you have a real extreme setup, it doesn’t really matter whether you start with the highest APR loan first or not. So we decided to go for the lowest CC’s first – it works encouraging to see a debt completely paid off, and it reduces your liability regarding minimum payments (suppose disaster strikes and for three months you have no money – but now you only have THREE minimum payments instead of FOUR…)

However, from personal experience I can assure you that CC companies are scared sh%tless about losing the goose with the golden egg – as soon as you pay off a CC, they’ll increase your limit and shower you with free credit transfer checks and usually no APR for three months.

We used this mercilessly to lower our APR payments and accelerate our payments even more.

Don’t listen to “experts” who say that you MUST start with lowest APR – that is based on a marginal difference and looks at the numbers only – instead, focus on paying off lowest CC debt first.

We’re planning to pay off one credit card entirely by the end of this week. That’ll be our first real “snowball.” Then we can turn our attention, and money, to the car payments. Student loan repayment doesn’t start until next year.

I love the idea of a day by day plan for getting out of debt. This is great stuff. I’m looking forward to the last 10 days.

Barbara Stanny, author, “Overcoming Underearning”

http://www.barbarastanny.com

Great post! This is awesome and people who are in debt and want to get out need to start doing something like this.

It keeps you motivated, on track and really helps you succeed and actually DO it.

Once you’re keeping track like this you start sticking to your plan and you also stop splurging on unnecessary things.

I made a simple spreadsheet with my debts, months of the year, and balances… With my debt/wealth at the end. I update it every time I make a payment.

Whoa all those numbers are making my head spin.. hehe. Great post. I’m very glad to not have any debt.. =)

This is a good break down. I will be facing paying off allot of debt when I graduate in a little over a year. I have been working on a plan to pay it off an have it on my blog if anyone is interested.

This is, assuming two things:

1. you have extra money to make extra payments

and, in addition to making extra payments,

2. you are no longer adding to your credit card balances

Shouldn’t you organize it by highest interest rate first, rather than by balance?

Robert… Did you read point 1? Some choose to go by balance – others by rate..

NCN

Here is how I handled everything with a balance transfer. I left Credit Card #1’s balance intact (because the interest rate was low and the balance about the same as Credit Card #2 (where the interest rate was about twice that of Card #1). I did a balance transfer for most of the balance from Card #2 to a 0% for 12 months card — let’s call this New Card — and aggressively paid off the small remaining balance on Card #2

I have taken the balance on New Card and divided it by 11, and I set aside that amount in my budget each month for New Card. Since it was at 0%, I pay only the minimum and then stuff the remainder into a high-yield savings account, to gather interest until the month before the 0% offer ends. What’s the point of having a 0% offer if you don’t have enough to pay it off before the offer ends?

Once I paid off the remaining balance on Card #2, I sent a snowball to Card #1 every month, plus have been making smaller payments as I have extra money — money that I saved from my gas/groceries/miscellaneous budget, monetary gifts, rebate checks, reward checks, half of my overtime pay, etc.

Instead of paying two credit cards, I ended up dividing the debt between three credit cards (at least until Card #2 was paid off) and making two transfers to high-yield savings each month. It was a bit more complicated to track, but it will have saved me well over a thousand dollars in interest, because of the balance transfer and paying off the highest rates first.

I also decided to open a new credit card in the process (Card #4), which is a Chase Freedom VISA. I use this for as many purchases as I can and pay it off at the end of each month. I use the cash rewards checks as extra payments to Card #1 to bring down the balance even faster. Once the debt is gone I will use the rewards to add to my Roth IRA.

This method is not for everyone, but it works for me because I use a detailed spreadsheet, refuse to touch the high-yield savings account, and can manage a rewards card without incurring additional debt.

Great article! Very simple, concise and encouraging too! I will try to implement it in my personal debt crisis.