My wife and I continue to work hard to payoff our mortgage.

As of the end of August 2013, my wife and I will have lived in our home for 3 years and 6 months.

We have a conventional, fixed-rate, 15-year mortgage and our goal is to pay off our mortgage in less than ten total years. We are behind on our goal – but working hard to achieve it!

As of September 4, 2013, we have made 42 regular, monthly mortgage payments.

We have also made several additional principal-only payments, too.

We usually make our mortgage payment on the first day of the month, but we made our September payment a few days later.

Additional principal-only payments are made throughout each month, as we earn additional income and find ways to decrease budgeted-for expenses.

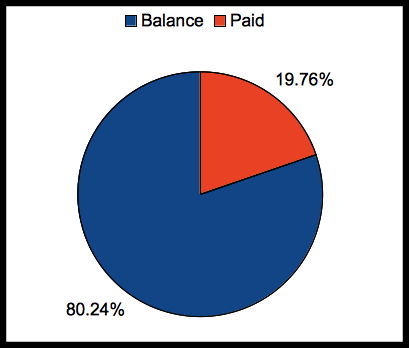

Here is our most recent chart –

The chart shows two percentages:

The blue percentage is how much I still owe – the balance.

The red percentage is how much I have reduced – the paid.

This chart reflects how much of our mortgage balance we have paid – not how much we actually own. That percentage would be much higher.

While property values in our rural neighborhood have remained relatively stable, recent home sales in our area show a slight uptick in sales prices.

This is a great way to keep your finances from ballooning under your nose. On the advice of my financial consultant, I have now started to use tools like mint.com to keep me in the know of what’s going on with my money.