My wife an I are working hard to achieve our goal of paying off our mortgage early.

As of March 2013, my wife and I will have lived in our new home for 3 full years.

We have a conventional, fixed-rate, 15-year mortgage. We recently reduced the interest rate on our mortgage.

Our goal is to pay it off our mortgage in less than ten total years.

As of March 1, 2013, we will have made 36 regular, monthly mortgage payments.

We have also made several additional principal-only payments, too.

We make our monthly mortgage payment by the first day of the month.

Additional principal-only payments are made throughout each month, as we earn additional income and find ways to decrease budgeted-for expenses.

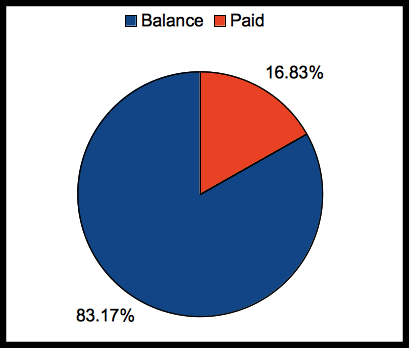

Here is our most recent chart –

The chart shows two percentages:

The blue percentage is how much I still owe – the balance.

The red percentage is how much I have reduced – the paid.

Now that we have lowered the interest rate on our mortgage, a larger percentage of our regular monthly payment will go towards principal, which rocks. Also, if we continue to make our old payment, we’ll pay of our mortgage even sooner, which rocks, too!

We are still sending extra, principal-only micro-payments.

Unlike credit card companies, our mortgage provider does not apply micro-payments throughout the month. Payments are processed on a single day. We believe in a “hands-on†approach to debt reduction.

This cart simply reflects how much of our mortgage balance we have paid – not how much we actually own. That percentage would be much higher.

We have made 35 regular payments and have lived in the house for a little more than two years. Our contractual remaining term is 12 year , but our actual remaining term is 11 years and 7 months. We have reduced the length of our mortgage by 5 months!

View all post related to our mortgage payoff progress.

Side note: Our goal is to own our home, mortgage-free. When we first moved in, there were several houses for sale in our neighborhood. As of today, those houses have sold and we feel great about the value of our home. We live in a rural areas, so prices are relatively stable. We also contribute to retirement.

Hi,

This is great. We currently have other debt that we need to clear out first but then will be hitting the mortgage hard. I read your blog “reduced the interest rate on our mortgage”. I never even heard about that before. I am not sure if it will work with us already having a low ARM rate but good to know for the future. Keep up the great work.

Great job in cutting the length of the mortgage and it’s nice to see houses being sold around you, let’s you know you’re not standing in a stagnant pool so to speak!