It’s that time again – time for an update on our mortgage payoff progress. As a reminder – My wife and I have a conventional, fixed-rate 15-year mortgage. Also, yesterday, we finalized the process of reducing the interest rate on our mortgage, and re-amortized our loan. So, our August 1st payment was the last payment made under the old interest rate – and the September 1st payment will be the first to be made under the new interest rate.

My wife and I purchased our first home back in February of 2010. Since then, we have been working hard to reduce our mortgage principal and payoff our mortgage early.

Our goal is to pay it off our mortgage in less than ten total years.

As of August 1, we have made 29 regular monthly mortgage payments. We have also made several additional principal-only payments.

Our mortgage payment is drafted from our primary checking on the first day of each month. Additional principal-only payments are made throughout each month, as we earn additional income and find ways to decrease budgeted-for expenses.

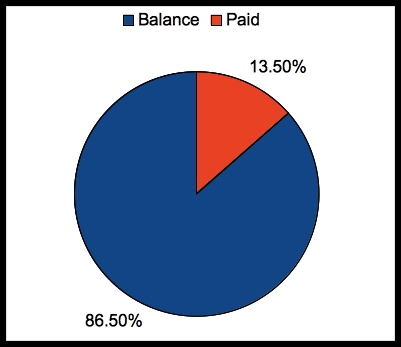

Here is our most recent chart –

The chart shows two percentages.

The blue percentage is how much I still owe – the balance.

The red percentage is how much I have reduced – the paid.

Now that we have lowered the interest rate on our mortgage, a larger percentage of our regular monthly payment will go towards principal, which rocks. Also, if we continue to make our old payment, we’ll pay of our mortgage even sooner, which rocks, too!

We are still sending extra, principal-only micro-payments. (Unlike credit card companies, our mortgage provider does not apply micro-payments throughout the month. Instead, all payments are processed on a single day. However, we send them in, throughout the month, because we like a “hands-on” approach to debt reduction. Being mindful, daily, helps to keep us motivated and focused.)

This chart does not represent how much of my house I actually own. It simply reflects how much of our mortgage balance we have paid.

We have made 29 regular payments and have lived in the house for a little more than two years. Our contractual remaining term is 12 years and 7 months, but our actual remaining term is 12 years and 2 months. We have reduced the length of our mortgage by 5 months!

View all post related to our mortgage payoff progress.

congratulations on the extra you have been paying off. As you keep doing this, the balance will come down faster and faster. Very exciting.

Congrats on your progress! 🙂

Paying off your mortgage in 10 years is really great. Do you live in a low cost of living area? 10 years would be hard in a lot of places!

Keep up the good work! My husband and I refinanced our mortgage in Nov. 2011. The first payment of the refinace/15 year mortgage began January of 2011. Since then, we’ve paid down $112K and our goal is to pay 50% of the morgage by December 31, 2012. We would like to pay the remaining 50% in another 2 years. As of today, if we stop making extra principal payments, we only have 7 years left on our mortgage. It has not been an easy feat, especially since we also put our son through college using cash only (he’s on his last semester of college). We are blessed with good incomes, but this would’ve never been possible if we did not make sacrifices along the way. We are hoping to be completely debt-free in 2 years (house and all).