It’s time for an update on our mortgage payoff progress. As a reminder – My wife and I purchased our first home back in February of 2010. Since then, we have been working hard to reduce our mortgage principal and payoff our mortgage early.

We have a conventional, fixed-rate 15-year mortgage. Our goal is to pay it off our mortgage in less than ten years.

As of June 30, 2012, we have made 28 regular monthly mortgage payments. We have also made several additional principal-only payments.

Our mortgage payment is drafted from our primary checking on the first day of each month. Additional principal-only payments are made throughout each month, as we earn additional income and find ways to decrease budgeted-for expenses.

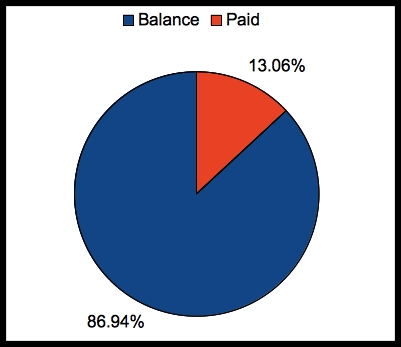

Here is our most recent chart –

The chart shows two percentages.

The blue percentage is how much I still owe – the balance.

The red percentage is how much I have reduced – the paid.

Each month, a little bit more of our regular monthly payment goes towards principal and a little less goes towards interest. Right now, the split is roughly 56.5/43.5. It will not be long before the percentage going towards interest is below 40%!. We are still sending extra, principal-only micro-payments. (Unlike credit card companies, our mortgage provider does not apply micro-payments throughout the month. Instead, all payments are processed on a single day. However, we send them in, throughout the month, because we like a “hands-on” approach to debt reduction. Being mindful, daily, helps to keep us motivated and focused.)

This chart does not represent how much of my house I actually own. It simply reflects how much of our mortgage balance we have paid.

We have made 28 regular payments and have lived in the house for a little more than two years. Our contractual remaining term is 12 years and 8 months, but our actual remaining term is 12 years and 3 months. We have reduced the length of our mortgage by 5 months!

View all post related to our mortgage payoff progress.

Your hard work shows how a few extra payments can drastically change the length of your mortgage and save on all that dratted interest. It is hard work but it sure has visible rewards. Congrats!!

That’s a fantastic achievement! Unfortunately for us, it’ll be a long time before we reach a similar percentage in our payments. I’ve been lurking a while and wanted to ask – do you use any software to make the pie chart showing how much you have paid off? I use a spreadsheet to keep track of our payments and slowly reducing principal, but being excel formula illiterate, I am unsure how to make the calculation for the chart. The visual is definitely much more appealing than the table!

Good reach, thanks for the info.

Well done.. this is great to see! A personal question I know but out of interest, what age (roughly) will you and your wife be when you pay off your mortgage in full if all goes to plan?

Neil