Two years ago my wife and I purchased our very first home.

We have a conventional, fixed-rate 15-year mortgage. Our goal is to pay it off our mortgage in less than ten years.

As of April 9, 2012, we have made 25 regular monthly mortgage payments. We have also made several additional principal-only payments.

Our mortgage payment is drafted from our primary checking on the first day of each month. Additional principal-only payments are made throughout each month, as we earn additional income and find ways to decrease budgeted-for expenses.

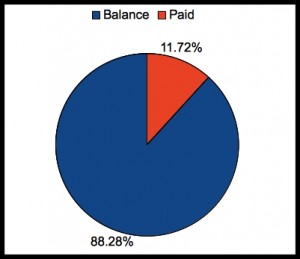

Here is our most recent chart –

The chart shows two percentages.

The blue percentage is how much I still owe – the balance.

The red percentage is how much I have reduced – the paid.

Each month, a little bit more of our regular monthly payment goes towards principal and a little less goes towards interest. Right now, the split is roughly 55/45. Seeing 45% of our payment going towards interest really stinks. That’s why we are so committed to sending extra, principal-only micro-payments. Our mortgage is reduced, dollar-for-dollar.

This chart does not represent how much of my house I actually own. It simply reflects how much of our mortgage balance we have paid.

We have made 25 regular payments and have lived in the house for almost two years. Our contractual remaining term is 12 years and 11 months, but our actual remaining term is 12 years and 6 months. We have reduced the length of our mortgage by 5 months!

Now that I have a new job, we’re still ironing out the wrinkles in our monthly budget. We’re unsure as to the exact amount we’ll have, each month, for debt reduction. We know that we can’t be as aggressive this year as we were last year, but we are still focused on our goal. Our steps may be smaller, but we’re still headed in the same direction.

View all post related to our mortgage payoff progress.