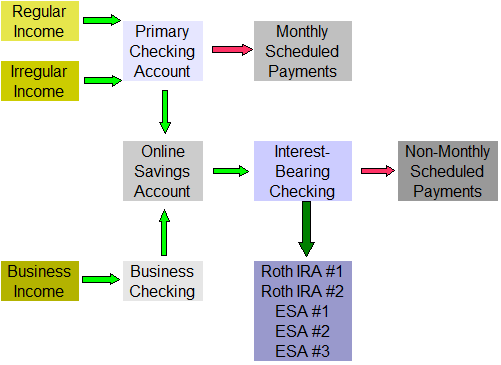

For the visual-learners in the audience, I have diagrammed the flow of my money.

Regular income is deposited into my primary checking account. Scheduled monthly payments are made, and allocations for non-monthly scheduled payments are then deposited in my online savings account.

Irregular income, such as it is, is deposited into my primary checking account, and used, if needed, for scheduled monthly payments. If not needed for scheduled monthly payments, money will be transferred from my primary checking account to my online savings account.

Business income is deposited in my business checking account. All business income is then transferred to my online savings account, set aside for non-monthly payments and long-term savings.

Any non-monthly scheduled payments are made from my interest-bearing checking account. Money necessary for non-monthly scheduled payments is transferred from my online savings account to my interest-bearing checking account, as needed.

Contributions to Roth IRAs and Education Savings Accounts are made from my interest-bearing checking account. Again, these contributions are first transferred from my online savings account, to my interest-bearing checking account, and then a check is written for each contribution.

I have it set so that I make all of my scheduled monthly payments on the first day of each month. As soon as payments clear, I can then transfer remaining money to my online savings account, leaving a cushion in my checking account for unforeseen-expenses. Not included in this diagram, but very important, is my envelope system, which I use for managing my cash, to pay for budgeted items like groceries and gasoline.

I am a big fan of the The ING Direct Orange Savings Account and I use it as my online savings account. I also use ING’s Electric Orange

as my interest-bearing checking account. Having both accounts with the same company, it’s very easy for me to make instant transfers.

For more about scheduled monthly payments and scheduled non-monthly payments, please see this recent article about how to create a zero-based budget.

Would you not benefit from limiting the distance money flows, say from checking, to savings, to interest bearing checking, to ROTH/ESA?

You dont specify how long each transfer takes but every day that the money is in transit is lost interest right?

I’m not sure why the two checking accounts — regular and interest-bearing. Why not do it all through the interest-earing one? Too many ATM fees? Or why not merge your “online savings” and “interest-bearing checking” into one high-yield money market account that lets you write checks?

Most people are visual so it helps to lay all this out. I assume it was also beneficial to you to see if this really is the most effective and efficient way to handle your money.

@bklyn dave

I use my local bank as my primary checking account… My employer does not offer direct deposit, or I would have checks directly deposited into either my savings / interest checking. Also, I like having multiple accounts, should something happen to one of the banks w/ which I do business.

@Jesse

While the transfers might take a few days, I always keep a “cushion” amount in each account, so that I can initiate transactions, of whatever amount, whenever I want.

Wow that’s nice and elegant. Just wondering, do you have some “redundancy” i.e. multiple paths to transfer money? Or did you just mark the ones that you (normally) utilize?

I tried to make one of my own a while back, but it was really messy; multiple checking accounts/saving accounts/ due to benefits and what not…

@SJ From time to time, I’ll make a direct transfer from my primary checking to my interest-bearing account, or even from savings back to primary checking, but for the most part, the arrows indicate the regular “paths”.

Where’s the toilet?