My goal for 2007 is to “save” $48,000 in various retirement, education, and investment accounts.

Click here to read all posts associated with my $48000 goal.

Click here to read about my savings and investing goals for 2007.

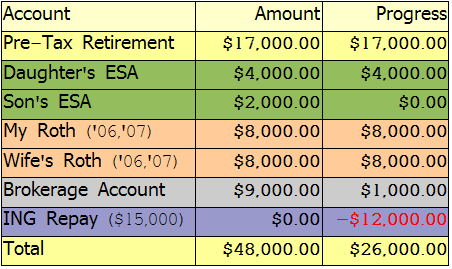

Here’s my updated chart with detailed information:

As you can see, I’m going to miss my goal… by more than $20,000! Yikes, right? Well, it’s not nearly as ‘bad’ as it seems.

My primary mini-goals were to fully-fund our retirement accounts. I managed to fully-fund my 403b, my wife’s pension plan, my Roth IRA (for 2006 and 2007) and my wife’s Roth IRA (for 2006 and 2007). I also fully-funded my daughter’s ESA (for 2006 and 2007). Mid-year, I decided not to fund my son’s ESA in 2007. I am going to fund his ESA in 2008. I also put $1000 into my standard brokerage account. All-in-all, I was able to put $38,000 into various retirement / education/ brokerage accounts.

But, all did not go as planned. First, when I opened my wife’s Roth IRA, I “borrowed” $5000 from my ING Direct Savings account. (I wanted to fund the Roth for 2006 and April 15th was right around the corner.) Then, in October, our old van began to “die” – so we decided to use some of our savings and purchase a newer van. So, instead of ADDING $10,000 to my savings, I actually DEPLETED my savings by $12,000. (I’ve managed to ‘payback’ $3,000.)

There are two ways to look at 2007. On the one hand, I managed to fully-fund 4 retirement accounts AND buy a newer car with cash. On the other hand, I missed my original goal and I actually lowered my “savings”.

Personally, I’ll always view 2007 as a success. While I did not reach my goal, I reached several “mini-goals”. In 2008, I’ll work to rebuild my “savings” – and I’ll continue to fully-fund the retirement/education accounts.

I still have a month to go and I’ll be working VERY hard to rebuild my savings account. I’m a little bummed to see the hit that our savings took, but I’m very, very happy with the newer van.

I don’t think you can view the van thing as a problem. After all, it wasn’t going to live forever. And so what you really have is a timing difference between when you replaced it and when you planned to replace it. Of course, it would be nice to save as much as possible, but you also can’t will reality to fit your needs.

Keep up the good work.

Kurt… That’s exactly how I see it. (I was going to buy a newer van in late 2008, which would have changed my 2008 goals… so I just pushed things “forward” a year or so…)

NCN

Sure, you didn’t meet your goal, but I’d still call that a banner year. That’s what I like about setting big goals- you can ‘fail’ but if you aimed high you will likely be much farther along than if you hadn’t tried.

I think you did well. You completed a lot of savings goals during 2007 and you purchased a nused van with cash (that’s an accomplishment – yay for no finance charges) that you needed. I think your 2007 goals were realistic and you would have come much closer if you had not bought the van.

I agree with everything you said. You didn’t fall short of your 2007 goals because of any poor financial decisions , it was because a needed expense came up earlier than you anticipated. Great job on a fabulous year! And now 2008 can be a save, save, save year!

presumably the ING savings was for emergencies, and that is what it was used for. Your overall objective of $48k was based upon not having emergencies, and it did not include the plan to buy a newer car (or did it?); moreover, you also had sufficient savings to cover both funding your wife’s IRA and covering the van repair. I would say, that your budget ended up doing exactly what you wanted it to do.

lessons learned:

first, those unplanned purchases can affect your savings goal, so adjust your savings goal accordingly. second, emergencies can affect your savings goal, so its good to have an emergency fund so you can absorb them. third, when planning your 2008 savings plan, figure in some buffer in order to absorb unexpected expenses. I think $48k was too lofty in terms of not accounting for unplanned purchases or expenses, and having to refund an emergency fund in the event of these occurrences. either way, you did well. we were also $20k off our savings goal, trying to limit our expenses to 10% of our income and saving 90%.

This just goes to show the importance of having a emergency funds/spare cash for any eventualities.

Life happens, things break. In my books, you are still ahead of the game.

The fact that you have a goal, and that you tried hard to reach it is amazing.

By my calculations, our salaries are very similar, I was able to put away nearly 50% of gross and so I can definitely empathize with your lofty goal of 60%.

You still saved 45%, AND you have two children from what I can tell. Very impressive! I would be curious to see percetange of the population of which you are saving more than (relatively speaking compared to your gross). I’m guessing it’s over 99%.