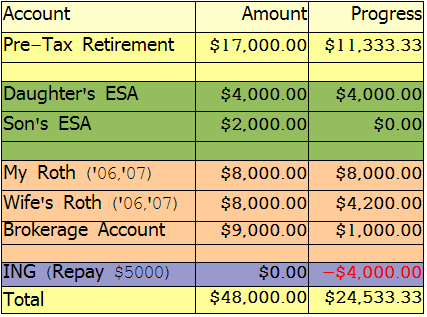

My main goal for 2007 is to save 60% of our gross household income ($48,000) in various retirement, brokerage, and education savings accounts.

Here’s my current, updated chart:

(I’ve also updated my chart over at the No Credit Needed Network: NCN 2007)

I made a couple of adjustments to my chart. Pre-Tax Retirement Goal was increased by $1000 and Brokerage Account Goal was decreased by $1000. Why? I recently made a few changes to my retirement contributions at work and I wanted my $48,000 Goal chart to reflect these changes.

I’m sure there’s a perfectly good reason, but why is your son’s ESA being funded with less money than your daughter’s? (And for that matter your wife’s Roth compared to yours?)

Plonkee… I opened my Roth a few months before I opened my wife’s… so, I funded mine for 2006, then hers for 2006, then mine for 2007, and now working on hers for 2007…

As for the kids, My daughter is 7, and I opened an ESA for her when she was 4… My son is 3, and we’ll be opening his ESA when he turns 4…

NCN

That makes sense – just checking it wasn’t an oversight.

Since you are attempting to save 60% of your gross income, shouldn’t your pre-tax savings be adjusted for taxes? Comparing apples to apples, the $1,000 in your brokerage account was worth more than $1,000 in your pre-tax account.

For that matter, shouldn’t all of your pre-tax money be calculated with these tax concerns in mind?