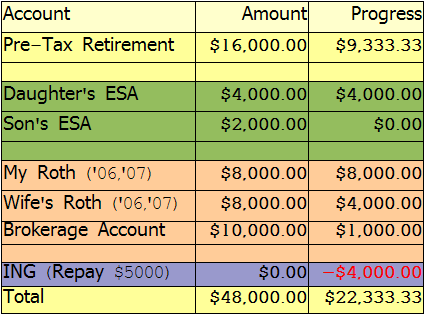

I’ve been making steady progress towards my goal of saving $48,000 in 2007. In the middle of June, I ‘borrowed’ a little money from my ING Direct account so that I could go ahead and fully-fund my Roth IRA for 2007. Now I’m working on rebuilding my ING Direct account. (Remember, no matter what my current goal is, I always leave enough money in my Emergency Fund account to cover 6+ months worth of expenses.) So far, I’ve managed to save $22,333.33 in various retirement and education savings accounts. That means I’m $1666.67 BEHIND where I’d like to be. (Halfway through the year, I’d hoped to have $24,000 saved… but, I’m not discourage, at all! Why? I’ve got 6 more months to work towards my goal, I’m saving more than 50% of my gross income, and I’ve yet to get on a really, really tight budget. All in all, I’d give myself a solid B, but I’ll need A+ work over the next 6 months if I plan to meet my goal.) Here’s a chart of my current progress:

As you can see, I’ve fully-funded my Roth and my daughter’s ESA. Pre-tax retirement accounts are automatically funded, so all I really have to worry about is 1/2 of my wife’s Roth, my son’s ESA, and then our Brokerage Account.

$22k in a year is still pretty good! Just having a goal can be important. I have a $33k goal by Oct 2009 (coming out of 15k of debt). Makes me feel better just having something to shoot for. What does ING repay mean?

Wow, good job. I’d like to know more about how you are managing to save this much, your post states you are not on a tight budget, I assume you are on some type of budget?

Chris… I ‘borrowed’ $4K from my savings account so that I could go ahead and fund my Roth IRA…

Sam… In other words, I still have a lot allocated to “miscellaneous” and “fun”… I could tighten those two categories…

NCN

I have another question. You said you were saving 50% of your income. Were you already doing this, or went cold turkey and slashed excess weight from your budget, or did you gradually reach this amount?

Wow! Great job saving! I wish I was able to save that much annually….

Chris… After getting out of debt (and learning how to budget our money)… saving a significant portion of our income became important… So, we try to live responsible, somewhat frugal, lifestyles… NCN