This post is part of the Money Blog Network monthly project – Finances at Graduation

Dear High School Graduate:

I’ll keep this short and sweet. One day, you’ll probably want to retire. But, in order to do so, you are going to need money – and lots of it. Do yourself a huge favor. Open up a Roth IRA and do your very best to fully-fund it. Need some motivation?

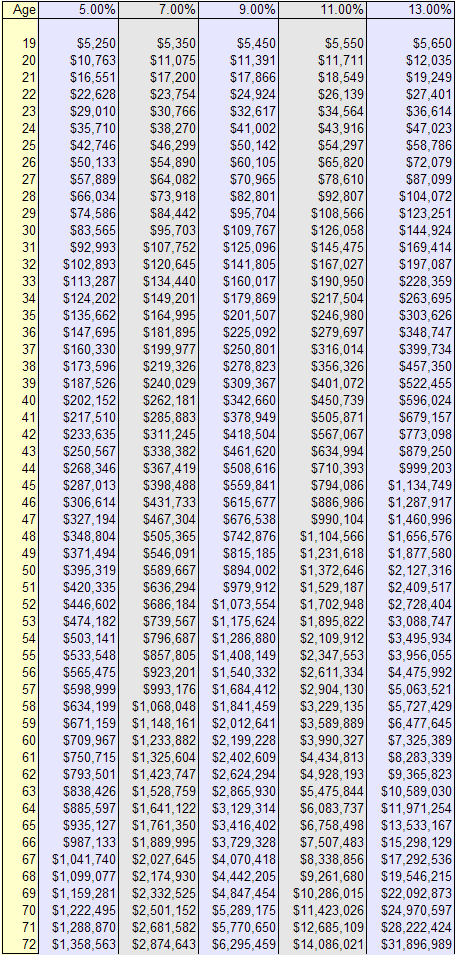

Here’s a chart depicting what could happen if you invested just $5000 at the age of 18 – left it alone – and withdrew it at the age of 72.

As you can see, rate of return is a big deal. I encourage you to read one of my favorite books – The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns (Little Book Big Profits) – It will help you understand the stock market and rates of return.

Please note, the calculations above are based on a single $5000 contribution, made at the age of 18.

Imagine if you made $5000 contributions, each year, until the age 72 –

Wow. Even at a conservative return of 9%, your ending balance would be over 6 million dollars. Pretty cool. And, if you get ‘lucky’ – you’ll have more than 31 million dollars with which to play!

There are several ways to open a Roth IRA. Visit your local bank and ask them about opening a Roth IRA – or do it yourself, online, at sites like TradeKing or Vanguard.

I realize $5000 is a lot of money – especially when you are 18. But, look at the potential rewards!

One final note – Money inside of a Roth IRA grows tax free! That’s right. Pay taxes now, while your tax rate is relatively low, and watch your contributions grow and grow and grow. Then, when you are ready to retire, you can withdraw money from your Roth IRA – and you will not have to pay taxes on those withdrawals.

Your debt free friend,

NCN

Be sure to check out the other contributions to this topic:

Consumerism Commentary – Financial Tips for College Graduates

Free Money Finance – Money Advice for Graduates

Get Rich Slowly – Personal Finance Made Easy

Mighty Bargain Hunter – Graduates, You Might be Shocked

No Credit Needed – A Fully Funded Roth at Age 18

Wise Bread – My Best Advice for New Graduates

Five Cent Nickel – Four Tips For Recent Graduates

Side Note: With any investment, there is a potential for loss. Also, inflation effects the real rate of return on any investment. I just love to crunch numbers and think “what if” about future financial goals.

Thanks I am looking into either TradeKing or Vanguard – any other recommendations?

If you can earn 13% after interest for 53 straight years, you’re going to be rich anyway, because you’re an investing genius. The 5% column is most realistic.

@Eric.. you might look at Fidelity or any of the other online brokers…

@Keving… the Compound Annual Growth Rate for the S&P 500, between 1993 (the year I graduated) and 2007 was 8.41% and the Annualized Growth Rate was 9.71%… I invest (primarily) in index based mutual funds and ETFs…

NCN

Sure this advice sounds sexy and appeals to my sense of greed, but I don’t think its realistic.

The graduate is going to have to wait 40 years before they can touch that money without penalties.

Better advice is to have Mom/Dad/Granpa/Granma create the account and have the kid fund it. This should drop the waiting period for tax free money from 40 years to 5 years.

I would add that kids should be encouraged to invest in Roth IRAs even before they are 18. If your kids earn income (baby sitting, dog sitting, paper route, etc.) they can invest in a Roth IRA. Here is an article on the topic:

http://moneycentral.msn.com/content/Taxes/Preparationtips/P33215.asp

The money should be left alone, if should bee for retirement. Money you invest in a Roth IRA can be withdrawn without penalty, but that defeats the purpose of the IRA.

The money should be left alone, it should be for retirement. Money you invest in a Roth IRA can be withdrawn without penalty, but that defeats the purpose of the IRA.

The maximum contribution per year is 4000.00 is it not?

@Todd.. No, the maximum for 2008 is $5000.

That’s great, but it’s also meaningless without considering inflation. At 3% inflation over 54 years, that $3.5 million dollars will be worth about $700,000 in today’s dollars. Still not terrible, but it’s a far cry from $3.5M.

And the more realistic $500,000 after 54 years? That’s really about $100,000 in today’s dollars.

Sorry to be a wet blanket, but I think it’s important to inject a little honesty into this kind of post.

@anonymous – Ummm… You are correct, inflation could dramatically reduce the ‘value’ of 3.5 million dollars – but you’d still have 3.5 million dollars. And, over time, I’m pretty sure that the contribution limits will go up, in order to keep up w/ inflation. The point of the post, which I think most people understood, was to encourage people to start saving, as early and as often as possible.

NCN

I respect the role posts like this play in motivating youth to become interested in personal finance and make the leap to start funding their own retirement, but no amount of “luck” is going to make the stock market grow 13% every year for half a century. I don’t think it’s helping new grads to imply that all it takes is a little luck to see that kind of growth, or that 9% is a “conservative” estimate. Better they use the 7% column to do their “conservative” planning. 9%, even for a few years, is optimistic, let alone for the whole 54 year period. 13% for 54 years in a row is just plain fantasy.

Yah, big percentages make numbers very sensational very quickly. Try the Zimbabwean inflation rate for starters. Take the numbers above and subtract the effective inflation rate. Also consider that stock market returns are not constant, so the tables are not realistic by a long short. Stock markets have plateaued, declined, or increased for years or even decades in a row.

Actually, I believe one can withdraw money from their Roth without penalty — at least the contribution part. This defeats the purpose, of course. Worrying about inflation and guessing low on return percentage is just another way to encourage yourself to what? Not invest at all? People who argue this are going to tell you their sure-fire way to make 20% on the market, without risk.

Although this IS great, I would like to note two limitations:

1. You can only put UP TO YOUR PRE-TAX INCOME into a Roth IRA. If you earn $5000 in one year, you can fully fund your Roth IRA. If you only made $3000 this year, you can contribute up to $3000 to your Roth IRA. If you are a student with an unpaid summer internship, you LEGALLY NOT FUND your Roth IRA.

Of course, with a summer job paying $8 per hour, that’s 4 to 5 months of near-full-time work, so some people may be able to swing it – but you’d have to put 100% of that income into a Roth IRA. Which brings me to point #2:

2. You have to be able to afford to put $5000 into your Roth IRA. For most kids 18 and up, if they get $5000, it’s going toward college – not toward a Roth. Some parents might be willing to fund a Roth IRA (as mine were) but most are focused on just getting through college with as little debt as possible.

For those who are not attending college or who can afford funding the Roth, I absolutely agree with your advice.

I have been contributing the maximum into a Roth IRA for my son based on his wages from 16 through 21. Next year he will have at 21, 25 thousand dollars invested into a vanguard 500 index fund. We only have one child so my wife and I thought this would be a small sacrafice on our part to set him up even if he doesn’t put any more into it, it should grow quite a bt even taking inflation into account. Ideally a vanguard mutual fund VGENX would be a better avenue since it has averaged over 15% return since 1984, but it has a minimum $25,000 investment.

Actually, from 1950 to 2000, the average rate of return including dividends was 13.66% for the S&P, so yes, with some luck, 13% is achievable.

I am a bit late of the start but WOW thats opened my eyes a bit am off to see what ISA’s (UK Equivalent I think) will bring me back. Same I think TAX free and linked to stock market.

James

I’m not great at math, so maybe someone can answer this question for me: as Ryan said, the average rate of return for the S&P 500 over the past 50 years was over 13%. Does that yield the same amount of money as a steady, yearly 13% increase?

I’m wondering because percentages can be tricky, i.e. if a stock goes down 50% one year, it then needs a 100% increase in value to go back to its original worth. Does that change the significance of 13% “average rate of return”? Or does average rate of return mean the equivalent of a steady, 13% annual rise in value? Thanks!!

My government and politics teacher showed us these figures during my senior year in high school. It really motivated me to start my Roth IRA and I’ve been keeping it fully funded ever since! (Of course, that was only 6 years ago for me)

This is an awesome article (though as others pointed out, it might be slightly unrealistic)… For a new college student, would you recommend putting my money into an index fund?

@Michael,

While I don’t give investment advice, I personally own several, low-fee index funds and ETFs.

And, personally, I don’t think that the chart is all that unrealistic…

NCN

Thank you so much for this information – I’ll be 18 in late February, and only this morning was looking into Roth IRAs and high-yield savings accounts. I’ll be living on my own during college (which will be quite expensive enough, of course), but right now earn quite a bit per month in SS Survivor’s benefits, and while I won’t be able to invest QUITE $5,000 when I’m 18, I’ll have enough by the time I’m nineteen that this chart really helped me ballpark where I’ll be by the time I’m old enough to retire.

These tables are reassuring and encouraging, even at the 5% column, and I wish more people my age would start thinking about retirement now, or even about their finances in general (I’ve taken two finance/business classes throughout high school, and it’s truly frightening how many young people have no interest in their money, and are completely careless and ungrateful for it).

Great advice and the figures look astounding from such a small initial investment, although I’m aware that nothing is guaranteed when it comes to the stock market, especially consistent 13% yearly gains, and especially in a volatile market like today.

As a Realtor in Spokane, WA, I definately understand the benefits of a Roth IRA, especially for the use of purchasing real estate investments.

For those who believe the 13% is not obtainable, think about this…l

Since 1929 stocks on average every decade have earned slightly about 10%. 2000-2009 the stock market has earned 0%. Never in the history of the stock market has there been back-to-back decades earning less than 10%. It is reasonable to believe with the idea of regression to the mean involved that stocks from 2010-2020 will earn near 20% if not more.

Think of the percentage returns as after inflation [10% annualized – 3% inflation = 7%] and keep on saving!

For a guide as to what to expect over the next decade see the quarterly report at GMO.com. Jeremy Grantham wrote in 1998 that the S&P 500 would likely return 0% over the next ten years [and he was right!].

Start early and keep saving!!!

My mom inherited $25,000 when she was 18. That was a lot of money then because a stamp was only 3 cents.

Time is on your side but inflation is your enemy!

About Anonymous’ comment that inflation could take a 3.5 million dollar return and change it into 700 thousand dollars, it was 5 thousand dollars initially that created that 700 thousand dollars. If I had to choose, I would give my 5 thousand dollars to make it 700 thousand dollars any day! Wouldn’t you? Complaining that it’s not 3.5 million dollars seems pointless. The alternative is either to invest your 5 thousand dollars or have it de-value over time, due to inflation. Investing is a wonderful way of having it keep its value over time and even add more to your wallet (way more)!

However, remember that little thing called inflation. Annually compounded at a very hopefull 1.5% average annual inflationary rate over 54 years is 0.015*54=0.8 $3,674,000 – (3,674,000 * 0.8) = $698,060 in today U.S. dollars. Now, this isn’t bad but you have to now figure on only getting an avg of 7% annual ret. on a fixed income fund vehicle of choice and that earns you $698,060*.07= $48,864 yearly income in todays US dollars. Not great, but liveable considering your home is probably paid off and children gone. But also bare in mind that the investor better know something about investing to get and 15% avg. return rate over 54 years! 9% is more realistic.

P.S.

Btw – I think I read somewhere that the avg. annual return rate over the life of the S&P 500 was somewhere around 8% if i’m not mistaken. Personally, people can do much better if they do a little homework and build a aproportionate size portfolio of high growth stocks and use good money management. 15% is certainly attainable. Like I said, do some homework. Don’t just put it in the S$P leave it there. Put your money in companies that are growing at a fast pace. S$P companies are good and offer stablility and divs but the longer a company has been around the slower their earnings growth and price movement. Divs don’t compare with good price movement.

Also, here’s a real eye opener: the $$ contributed in the early years of an IRA’s existance makes the biggest impact over the long haul due to compounding interest and time and the money contributed later makes the least impact. So when you are young, work hard and save!!,, be a little more risky because you have time on your side and less $$$ to lose and most of all because getting a large starting balance in the first 5 years of a 40-50 year account makes a bigger difference than yearly contributions for the remaining 35+ years! It is true. In other words, after your account reaches a certain size your contributing your “max” contribution “every” year will NOT have a significant impact on the final ending balance and you can even competely stop contributing if you choose to! At that stage your yearly contribution will be merely small change compared to the interest you make on the account. It’s true because the compounding “avg. annual return rate” you achieve and “time” become the power that drives the money machine not your yearly contributions! With this important knowledge it is critical that an IRA be fully funded from the START and the sooner the better.

Mike, you have to remember something, that figure of $48,864 yearly, for probably most people investing in a roth is not their only retirement income. If I am lucky enough to reach that amount and i stay at my current job at my current salary level I would be pushing 90k in combined income. with the Roth and my pension, i also qualify for alittle social security( if it lasts that long :p lol)

Is this a possible scenerio? Let’s say that I’m retired and grew my Roth IRA to $1M. I use that $1M to purchase a stock and then sell it after it has gone up 1% for a $10k profit. Can I withdraw that $10k profit without paying any taxes on it?

the headline does not match the article. shouldn’t it say a fully funded ira can net you 31.8 million?

I’ve been contributing to my Roth since 2008. Today I checked- after 5 years, I have 14% growth.

Where’s the 2.8%/year calculation on your chart, NCN?