Click here to read all of the 33 Days And 33 Ways To Save Money And Reduce Debt posts.

Day 24: Roth IRA

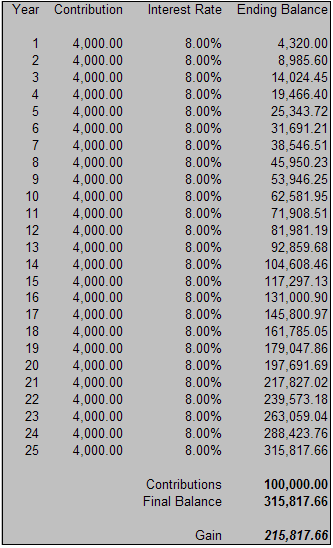

I opened two Roth IRAs last year – one for my wife and one for me – and I fully-funded them both for 2006 and 2007. Contributions to a Roth IRA grow tax-free – because all contributions are made with after-tax income. So, what if I invest $4000 (this year’s contribution limit) every year for the next 25 years, and I average an 8% return on my investments?

After 25 years, I will have contributed $100,000 dollars – but my account balance will be over $315,000. Not bad. If you are thinking about retirement, and you are eligible to make contributions, may I suggest that you consider opening and fully-funding a Roth IRA?

Please note: I realize that the actual return on my investment will be greater than or less than 8%. I simply picked a number and went with it. The market could go up by much more than 8% OR it could go down by much more than 8% – but I think that the historical data will support that 8% is a reasonable figure.

If you have written a post about Roth IRAs, contact me and I’ll be happy to link to your post.

Leave a comment about funding a Roth IRA.

Click here to read all of the 33 Days And 33 Ways To Save Money And Reduce Debt posts.

Synchronicity is crazy!

I finally just opened a Roth for my husband and I today!! We are pregnant with our second child and my deadline for getting this done had been before he arrives. I’ve been procrastinating since my first was born. Anyhow, I’m due in 7 days and just opened the Roth today.

I’m 34, so we’re behind the 8-ball for retirement. And, we only opened one for now. But, it was the best we could do and it’s better than the nothing we’ve been doing.

I feel relieved, proud, and nervous. I did as much reading as I could. But, when it came down to it I still felt in over my head & like I didn’t grasp all the concepts. But, I had to make my deadline and DO something.

Thanks for the timely post NCN.

(By the way, was it stupid to start a retirement account when we still owe money in student loans – no credit/consumer debt though…?)

Roth IRAs are a great way to invest for retirement. I have been investing in them since 2000, and have pretty much maxed them out every year since then (one year I only put in $2,000 after they moved it up to $3,000). It’s good to know that I still have 35 years or so for the money to grow!

Great post, and I hope uyou inspire a few people to open their own IRAs. Getting out of debt is important, but so is investing! 🙂

Something that will affect the calculation is the contribution limit for Roth IRAs will go up in years to come and you will definitely want to contribute more to compensate for inflation.

I started a Roth IRA the first year it was available. However, I find that I’m now getting phased out of Roth IRA eligibility because our legislators didn’t raise the income limits. Oh well.

NCN,

IRAs are one of the greatest retirement savings vehicles that exist. I’ve been contributing the max (or just enough to be in the zero tax bracket) ever since I had earnings as a teenager. I am very glad that I did that. Credit goes to my dad for teaching me about IRA benefits.