If you want to get out of debt, you need three things – a plan, some money, and lots of determination. I can’t provide you with the money or the determination, but I can give you some ideas for how to create an awesome plan.

- List your creditors, your current balances and your current interest rates.

- If you want to rid yourself of those pesky smaller balances, regardless of interest rates, list your debts smallest balance to largest balance. This method is commonly referred to as the Debt Snowball.

- If you want to ensure that you will pay the smallest amount of interest, over the course of your debt reduction, list your debts highest interest rate to lowest interest rate. This method is commonly referred to as the Debt Avalanche. (Source: Consumerism Commentary)

- If you simply have a debt that you want pay off first, regardless of its balance or its interest rate, list it first. Then, list your other debts accordingly.

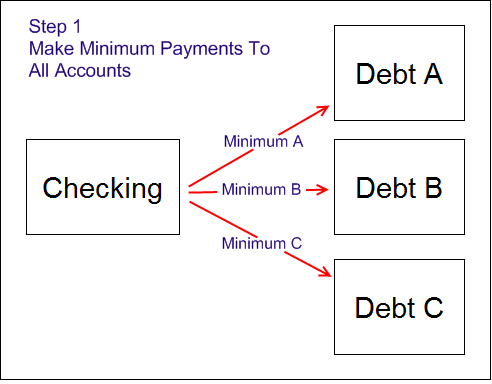

- Make minimum payments to all of you accounts. For your credit cards, this would be the minimum payment listed on your monthly statement. For your automobile loan, this would be the monthly payment. Make a note of these initial minimum payments.

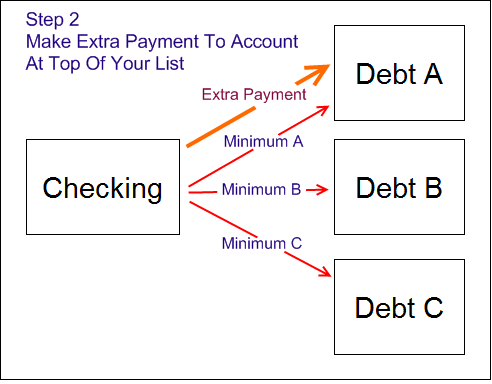

- Make an extra payment to the account at the top of your list. When sending payment, write “apply to principal” on the memo line of your check. Using online bill pay (initiating payments from your checking account to your creditors) is a simple way to send extra payments, without having to deal with envelopes or stamps.

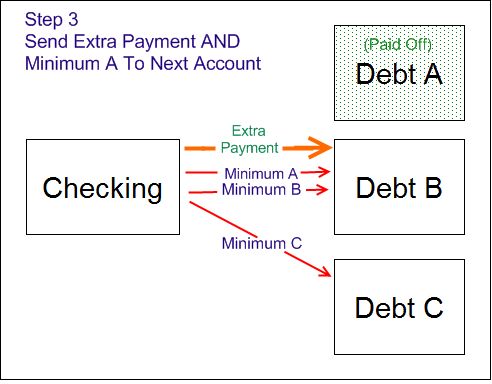

- Continue sending minimum payments and your extra payment until the first debt on you list is paid off. Then, combine your extra payment AND the minimum payment that you were sending to the first account, and send that combined amount to the second account on your list. This is where the snowball / avalanche effect really starts to work. Do not relax. Remember how I mentioned that you needed a plan, money, and determination? This is where the determination really matters. It would be so easy to spend the minimum that you had been spending to the first account, but then you would lose the impact of the snowball. Maintain your intensity and stay focused!

- By now, you have this figured out. Once you pay off the second debt, send the extra payment and the two original minimum payments to the next debt on your list. Continue combining these minimums and extra payments until you are debt free!

Want to do even more to ramp up your debt reduction? Don’t send one extra payment, send multiple extra payments. Keep your eyes open for ways to reduce your interest rates.

Click here to view the No Credit Needed Online Debt Reduction Guide or here to view and download the No Credit Needed Debt Reduction Guide E-Book.

This guide is beautiful. Thanks for putting it together with these visual aids!

Great illustrations, simple but informative!

Awesome. Now I can show my 7 year old nephew how to pay his debts. 😀

I view a lot of debt reduction articles and this has to be one of the first posts I’ve seen to really hit the point home with the simple visual demonstration. I think people who are struggling to get by and reduce their debt get too overwhelmed with the whole process. The necessity of that one extra payment a month can often be lost on those who probably need it most.

Nice job on the post. Hopefully more people can now better visualize their debts getting paid off faster than they thought possible.

Nice job!

Great illustration NCN.

So, do you write 2 checks? One for the minimum payment then a second one for the additional principal amount? Same envelope?

Why is it that pictures just make things so simple? I guess the old adage that they are worth 1000 words is true… Thanks for putting it together…

This is a great illustration of a great plan.

I like the addition about making multiple extra payments. This is something important to consider. I’ll use a personal example: We received a $115 loyalty certificate for our cell phone, which involved us extending our contract for two years from the date of redeeming it. Since we had just extended a month earlier, this was basically paying us $115 for an extra month. We are still paying the cell phone bill on the due date but instead of sending it to the cell phone company, we’re sending it to a student loan as an ‘extra extra’ payment.

Good reading!

@Denise you can send two checks, but in many cases, you can simply combine the minimum payment and the extra payment in one check… but, when i was getting out of debt, i would send all of my minimum payments at once… and then throughout the month, i’d send several extra payments… i used online bill pay so as to avoid paying for envelopes / checks / and stamps

Has anyone ever considered making only the minimu, payments on their mortgage (ie interest only), but buying a very, very cheap investment property and making massive overpayments on that mortgage? The overall effect is that the small mortgage will be paid off in super time. The investment property can then be sold off to put a major dent in your residential mortgage.

Great idea to use a visual guide to help people out. Its all great to write a long post about how to pay down your debt but a lot of people learn visually – for these people a series of visual cues will be much more effective.

Question regarding “Apply to principal payment”. If I dont indicate what happens to the additional amount payed? I assumed it went towards principal. Is that not the case?

Great article! Thanks

Great post on debt. Looking forward to seeing other articles as well. We are looking for link exchanges for our free access small business resource site. Take a look at us and if your interested send me a note.

The Business Mole 🙂

Add me to the list of people who really liked the visual!

@RT– depending on how the loan is set up and how much the extra payment is for, sometimes the “default” action is to push the due-date of the next payment out.

So, instead of having a lower principal, you just have a longer period of time before you HAVE to send them the next payment.

(This is bad for you, because you are paying interest on it in the meanwhile– by paying early, YOU’VE just given THEM an interest-free loan! Which is why it’s important to make sure they apply it to principal)

I like this visual example. My only suggestion is that people not limit themselves by making a single extra payment if they can make more. It doesn’t HAVE to be a single extra payment, you can pick whatever sum you choose above and beyond your minimum to send to ONE balance at a time.

Let’s say you have $200 a month to devote to debt repayment. You have three minimum payments, each $40. That means you would send $40 to two of the balances, and send $120 to the third! When the first is paid off, send $40 to one and $160 to the other, and so on. I would recommend people send every extra cent they can to debt repayment, and if you’re not in the mindset of only having to send “one extra payment”, you might be inspired to send more.

This is an absolutely great article. The diagram makes it extremely easy to read. The trick is to get past debt A. Once you do that you will be motivated and watch your debt disappear at an increased rate

Thanks for the great visual aids. I love them. In the first one, we feel overwhelmed, scattered and like we are barely keeping up. In the second, that feeling of empowerment is growing…and I like it. The third illustrates the feeling of Victory! — a small one but a victory worth celebrating nonetheless. And, the fourth, really hits home the “you can do it” part. You take everything you’ve got and fire away. That feels good.

I think you should add a 5th slide that shows “All for me and none for you”. 🙂

One thing I do to reduce the principle on my most nagging debt is, every single time I log in to my bank account, no matter what for, I pay that one creditor $25.00. I just make it a routine; when I long on, that’s the first thing I do, and then I take care of whtever it was I logged on to do. If I log in 12 times a month, that creditor gets an extra $400.00 over the agreed minimum of $500.00 a month. That knocks down a debt in a hurry. $25.00 a log on doesn’t hurt me that much, but it is definitely hurting that debt! It is a modified version of your strategy, and I can see it working in black and white!

Good infographic! It isn’t complicated but when people get snowed under by debt it can seem difficult to get out. This infographic give one good way. There are other ways each suiting different situations but this way is simple which is generally good!