I began 2007 with a goal of saving 60% of my gross income ($48,000).

(On this blog, whenever I say “my” I am referring to “household” income.)

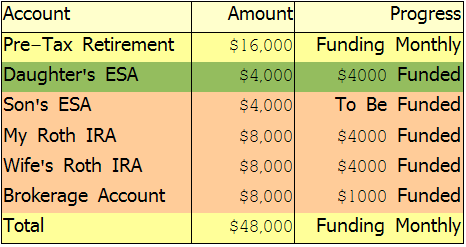

So far, I have fully funded my daughter’s ESA for 2006 and 2007, fully funded my Roth IRA for 2006, and fully funded my wife’s Roth IRA for 2006.

(In order to fully fund both Roth IRAs before April 2007, I “dipped” into my ING Direct Savings Account. I am now aggressively “paying myself back”.)

If I plan to live without borrowing money, I have to save a considerable amount of money. I need to have savings for major purchases that will occur in the next few years AND I need to save as much as I can in my retirement accounts. Remember, I don’t plan to borrow money EVER.

Here is a chart detailing my progress thus far:

–

If you subtract $16000 (my pre-tax retirement contributions) from $48000 (my total ‘savings’ goal for 2007) you get $32,000. I have “saved” $13000 of the $32000 in various types of accounts. If you add back the $5000 that I owe myself, you get a total of $8000 saved in 2007. $8000 is 1/4 of the way to $32000, so I am RIGHT ON TRACK! I will be focusing on TWO things in the next few months. I need to put $5000 back into my ING Direct Account, and I need to fund my son’s 2006 ESA, BEFORE April 17, 2007. I will likely withdraw $1000 from my Brokerage Account and then withdraw an additional $1000 from next week’s paycheck.

Just a word to all of you who are wondering about whether or not it pays to “pay attention to your finances”. The definitive answer, from my experience, is YES!

Great progress NCN! It’s really inspiring to see you pile up the successes.

NCN,

This is just an unbelievable accomplishment. You have saved more in just three months that most people do in a decade. Keep it up.